Unlock U.S. Financial Freedom for Global SaaS Founders

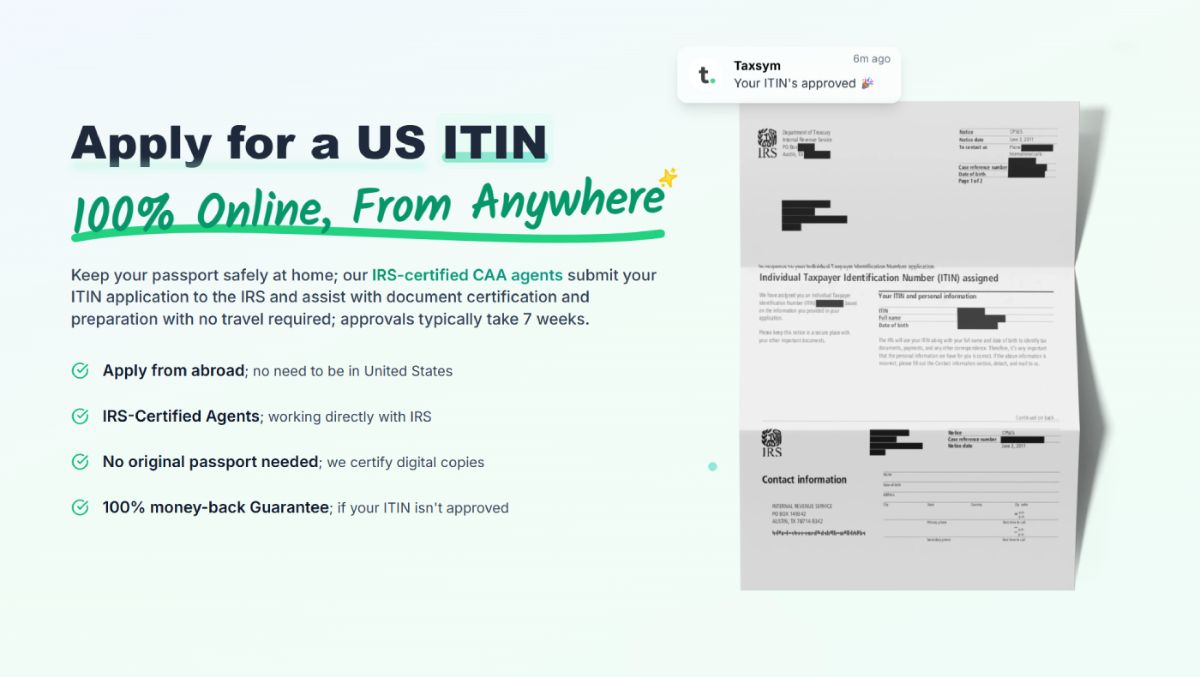

Taxsym delivers your ITIN entirely online, unlocking remote U.S. banking, payments, and credit cards for non-U.S. Residents & SaaS founders. 🌍

As an official IRS Certified Acceptance Agents (CAA), we expertly prepare your W-7 form, certify your passport scans digitally, and submit directly to the IRS.

The ITIN benefit?

As a powerful alternative to an SSN for non-U.S. residents, an ITIN lets you file taxes, open bank accounts, and access U.S. financial services without ever going to USA—perfect for global SaaS founders. Unlock remote access to U.S. banking, credit cards, and tools like Stripe to accept online payments, build your credit score, and scale operations worldwide.

Remote U.S. Bank Accounts 🏦: Use your ITIN to open and manage American bank accounts from anywhere, holding USD securely, receiving ACH payments and making international transfers.

Seamless Stripe Integration 💳: Leverage your ITIN for Stripe account, enabling U.S. payment processing, subscriptions, and revenue growth without borders.

Remote U.S. Credit Cards 📈: Qualify for personal/business credit cards like Chase or Capital One remotely via ITIN, building credit scores and earning rewards to fuel founder expansion.

Effortless Wire & ACH Access ⚡: With an ITIN, receive U.S.-based transfers directly into your remote account, streamlining payouts and reducing cross-border fees.

Simplified IRS Compliance 📋: Your ITIN ensures accurate tax reporting as a non-resident, helping SaaS founders file W-8BEN forms and avoid compliance hurdles.

Enhanced Global Credibility 🌟: An ITIN verifies your identity for platforms like PayPal US, Kraken US or brokerage accounts, boosting trust with investors and partners worldwide.