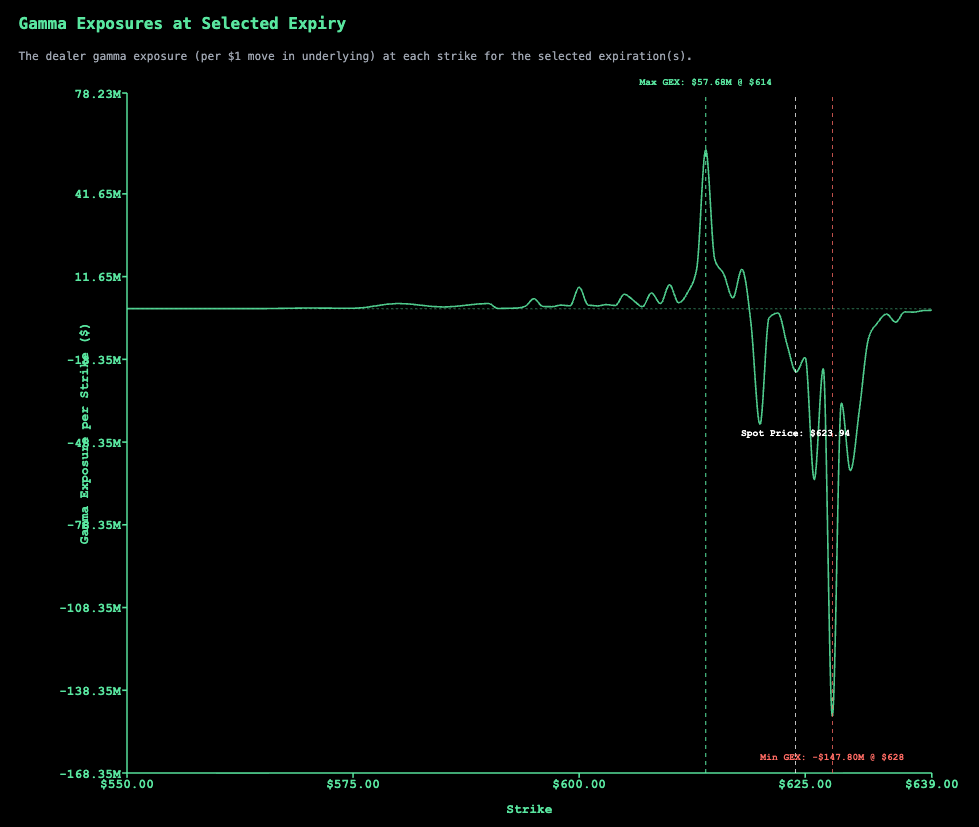

VannaCharm calculates dealer exposures based on open interest data and realtime options order flow of a given stock across all strikes and expirations. These are gamma exposure (GEX), vanna exposure (VEX), and charm exposure (CEX) - the three Greeks that arguably have the most significant impact on how dealers hedge and, consequently, how markets actually move.

If you've ever wondered why SPY seems to "pin" around certain strikes near monthly expiration, or why volatility spikes seem to accelerate moves in certain directions, VannaCharm can help answer these questions. Dealer positioning is often what causes such price behavior, and VannaCharm gives you a variety of tools to visualize and understand it.